What is the Toronto Land Transfer Tax?

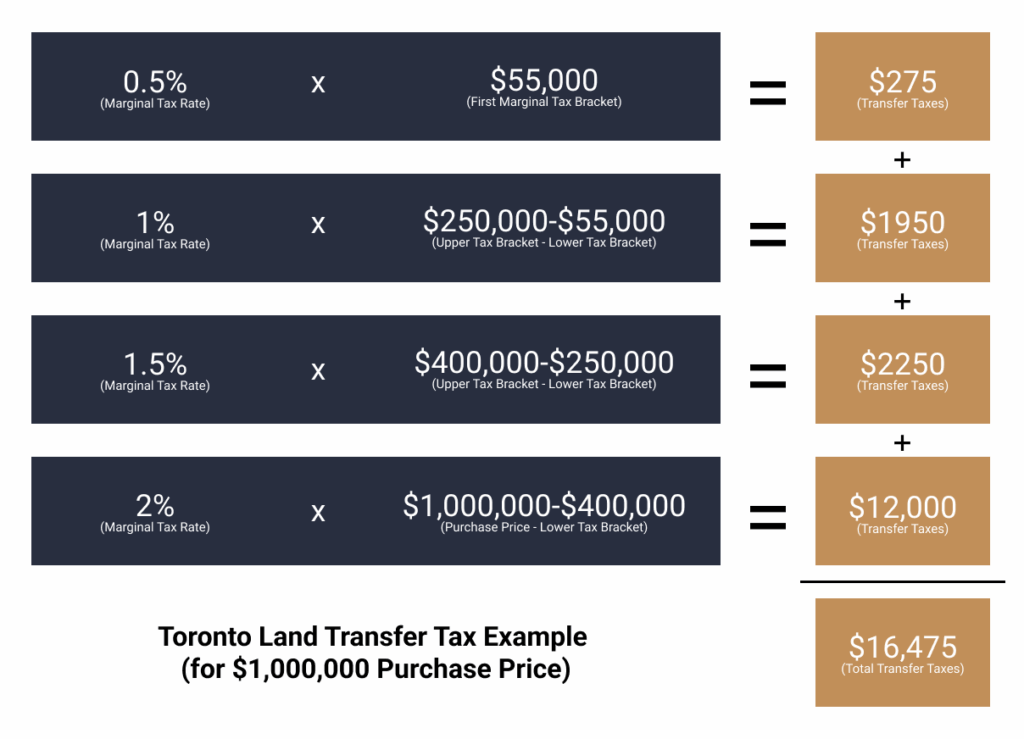

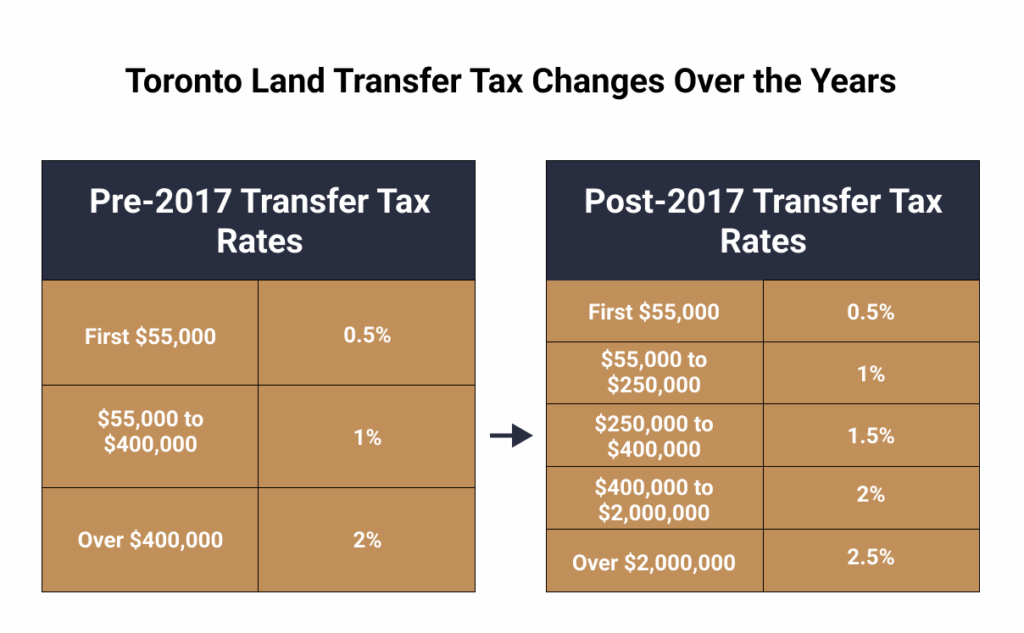

Land Transfer Tax (LTT) is a provincial tax in Ontario that you must pay when buying real estate. The amount is based on your property purchase price, including different marginal transfer tax brackets. If you are buying property in Toronto, the situation is slightly different — you will have to pay:

- Provincial Land Transfer Tax (PLTT)

- Toronto Land Transfer Tax (TLTT)

There is good news for first-time homebuyers — you can get a reduction in your land transfer tax bill for both your TLTT and your PLTT. To learn more about this, please contact our experienced real estate lawyer in Toronto, or you can read our blog about property taxes.

Below is a calculator designed to calculate the Toronto land transfer tax you must pay for your property. It is for BUYERS ONLY. And only for Toronto. Visit our Ontario Land Transfer Tax page to calculate the tax for other cities.